KUALA LUMPUR, Dec 14—Prudential Assurance Malaysia Berhad (PAMB) organized the Financial Youth Education Program 2024 in collaboration with the Malaysia-Japan International Institute of Technology (MJIIT), Universiti Teknologi Malaysia (UTM). The Mechanical Precision Engineering Student Society (PREMECH), UTM-MJIIT, coordinated the programme, which was held at Sakura Room, Level 4 of the MJIIT building. A total of 12 PAMB representatives conducted the programme for 26 UTM Kuala Lumpur students.

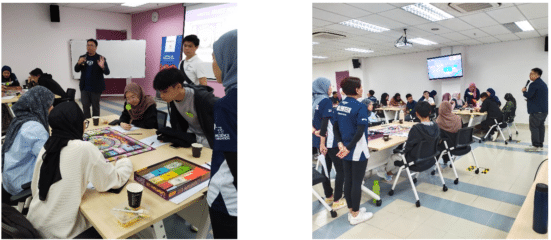

The program began with a brief welcome from the Program Advisor, Dr. Ahmad Faiz Mohammad, a Senior Lecturer at UTM-MJIIT. It then proceeded to Session 1, the Cash Flow Game, conducted by Eddy C. H. Yew. During this activity, participants were introduced to the concept of financial freedom and engaged in CASHFLOW, a board game created by Robert T. Kiyosaki, the author of Rich Dad Poor Dad. This game teaches participants about financial management and the principles of generating and sustaining wealth.

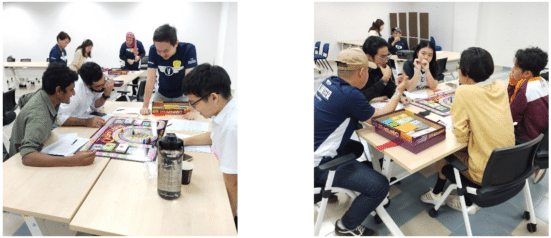

The participants were divided into groups of four, each assigned one to two facilitators from PAMB. Each group member was given a profession or occupation and their income details. The board game was interactive and enjoyable, allowing participants to test their understanding of finance through their choices. The ultimate goal of the game was to see if participants could achieve financial freedom. This session lasted for two hours and concluded with a lunch break.

After the lunch break, Session 2: Financial Seminar began at 2 PM. This session featured active learning and interactive activities, led by Muhammad Fiqry Idris from PAMB. Participants engaged in group discussions, case studies, role plays, and practical simulations.

At the start of the session, participants were introduced to the concept of a ‘dream’ as a representation of their life goals. They were encouraged to dream big and aspire towards their ambitions while also understanding the financial costs associated with achieving those dreams. This exercise was an eye-opening experience, helping them visualize how attainable their goals could be while motivating them not to give up on their aspirations.

Other important topics covered during the seminar included passive income, cash management, the different types of income (active and passive), insurance, risk pooling, the significance of investment, and debt management.

To help participants understand the significance of news and current events in investment decisions, the PAMB facilitators organized a ‘Stock Market’ game. In this game, simulated news scenarios related to the current economic and political climates were introduced. Each group represented a company, with one facilitator acting as a broker. The companies received news updates on current issues that influenced the stock market each week.

Over the course of five weeks, all groups had to decide whether to buy or sell stocks from a selection of companies, including AirAsia, Sunway Construction, KLCC REIT, Genting Malaysia, Sapura Energy, and Luxchem. At the start of the game, each company was given RM10,000 and no stocks. Based on the weekly news, participants collaborated to analyze the information and make informed decisions on whether to buy or sell shares.

This exercise simulated real-world investment dynamics, where market trends and external events play a crucial role in shaping financial outcomes. All five groups successfully increased their total cash by more than RM1,000, with the winning team boosting their total cash by over RM9,000. Although the total money was hypothetical, participants enjoyed learning about investments. As a reward, each member of the winning group received a RM20 shopping voucher.

The interactive learning techniques used throughout this program were well received by the participants. Most participants were engineering students from UTM Kuala Lumpur who had the opportunity to explore various aspects of financial management. This experience aimed to equip them with the knowledge and skills necessary for their future. Financial literacy is essential for personal and professional development, especially for young, aspiring engineers. This was the first-ever Youth Financial Programme conducted by PAMB at UTM, and it certainly will not be the last.